TOWNER COUNTY, ND LAND FOR SALE

361.59 +/- Acres

PARCEL 2 - SOLD!

|

* No rental contract for the 2015 cropping season.

* Good access to the property * Sellers to retain 100% of the owned subsurface mineral rights. Surface mineral rights will transfer to the buyer at close. * Sellers will retain the 2014 cash rent contract payment. * Sellers to pay the 2014 real estate taxes. * Farmstead on Parcel 1 is included and sold with no warranties. |

Property Directions: From Egeland, ND, travel 6 miles north on 72nd Ave NE. You'll come to a correction line. Turn east on 90th St NE and travel 2 miles. Parcel 2 is on the south side of the road. Continue traveling 1/2 mile east. Parcel 1 is on the north side of the road.

|

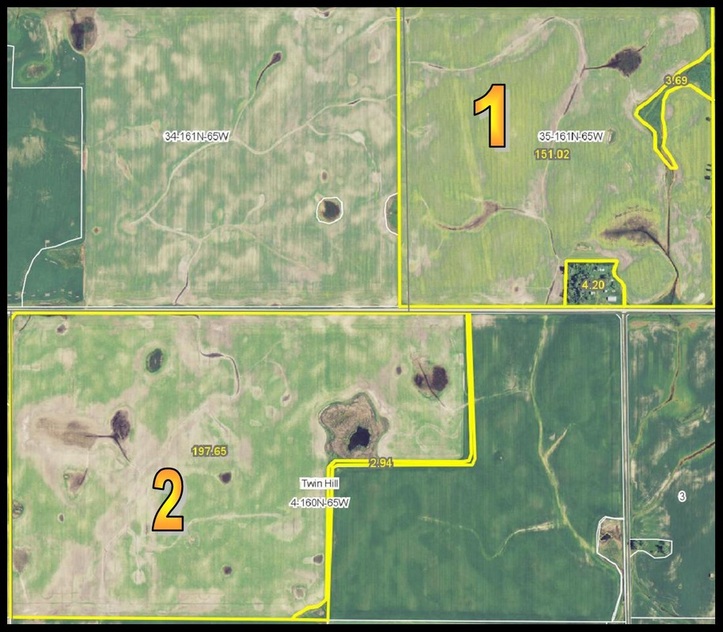

Parcel 1:

Legal: SW 1/4 Section 35-161N-65W, (Teddy Township), Towner County, ND

2013 Real Estate Taxes: $789.83

Deeded Acres: 160 +/-

FSA Cropland Acres: 151.02

Base Acres: Wheat 191.7 ac, 26 bu; Sunflowers 46.6 ac, 1,120 lbs; Soybeans 3.7 ac, 16 bu; Barley 69.6 ac, 38 bu; Canola 37.1 ac, 1,100 lbs (shared with Parcel 2) **FSA will have the final determination for the prorating of base acres and yields if necessary.

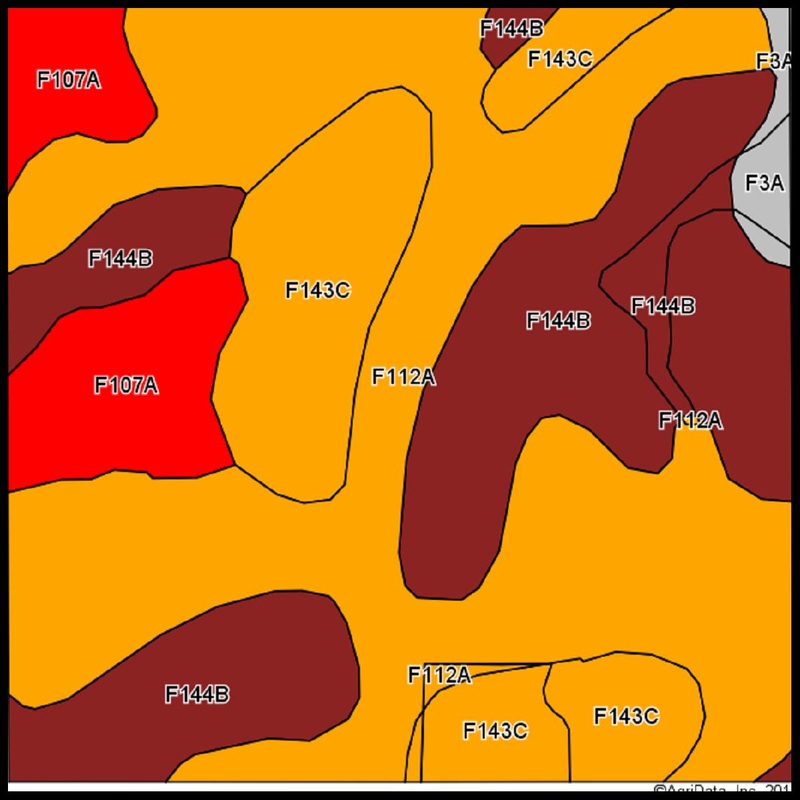

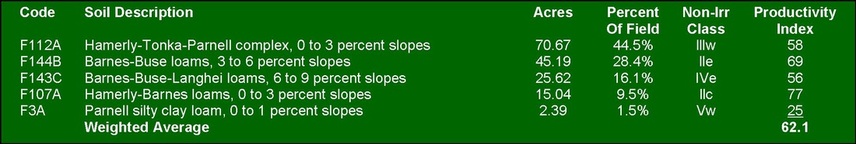

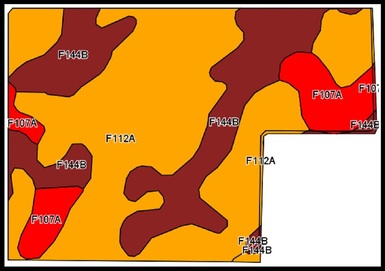

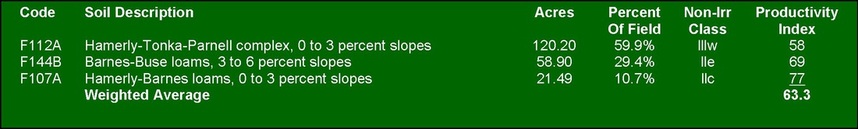

Soil Productivity Index: see maps provided below

2013 Real Estate Taxes: $789.83

Deeded Acres: 160 +/-

FSA Cropland Acres: 151.02

Base Acres: Wheat 191.7 ac, 26 bu; Sunflowers 46.6 ac, 1,120 lbs; Soybeans 3.7 ac, 16 bu; Barley 69.6 ac, 38 bu; Canola 37.1 ac, 1,100 lbs (shared with Parcel 2) **FSA will have the final determination for the prorating of base acres and yields if necessary.

Soil Productivity Index: see maps provided below

Parcel 2:

Legal: Lots 3-4 & S 1/2 NW 1/4 and Lot 2 of the NE 1/4 Section 4-160N-65W, (Twin Hill Township), Towner County, ND

2013 Real Estate Taxes: $1,139.15

Deeded Acres: 201.59 +/- (161.02 + 40.57)

FSA Cropland Acres: 197.65

Base Acres: Wheat 191.7 ac, 26 bu; Sunflowers 46.6 ac, 1,120 lbs; Soybeans 3.7 ac, 16 bu; Barley 69.6 ac, 38 bu; Canola 37.1 ac, 1,100 lbs (shared with Parcel 1) **FSA will have the final determination for the prorating of base acres and yields if necessary.

Soil Productivity Index: see maps provided below

2013 Real Estate Taxes: $1,139.15

Deeded Acres: 201.59 +/- (161.02 + 40.57)

FSA Cropland Acres: 197.65

Base Acres: Wheat 191.7 ac, 26 bu; Sunflowers 46.6 ac, 1,120 lbs; Soybeans 3.7 ac, 16 bu; Barley 69.6 ac, 38 bu; Canola 37.1 ac, 1,100 lbs (shared with Parcel 1) **FSA will have the final determination for the prorating of base acres and yields if necessary.

Soil Productivity Index: see maps provided below